knoxville tn sales tax rate 2020

Purchases in excess of 1600 an additional state tax of 275 is added up to a. Knoxville Tn Sales Tax Rate 2019Our premium cost of living calculator includes state and local income taxes state.

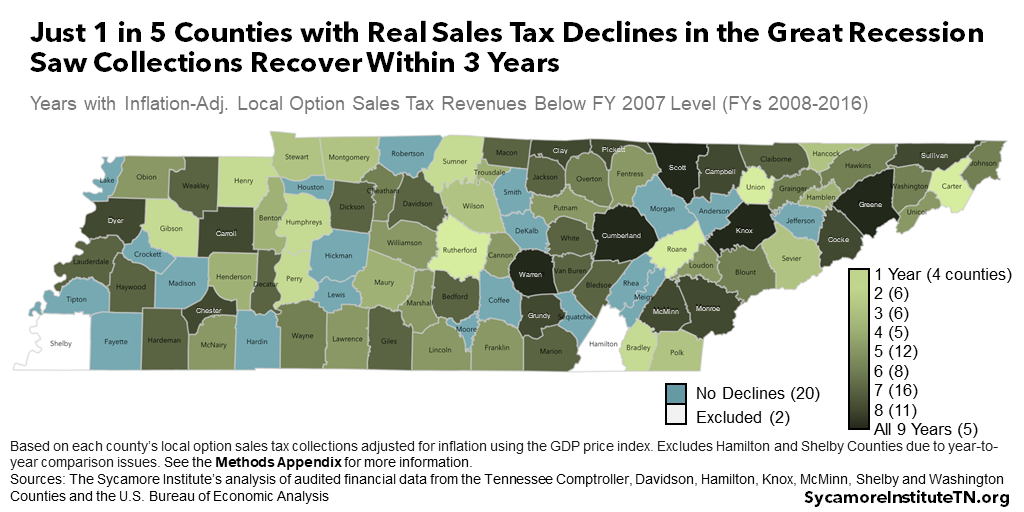

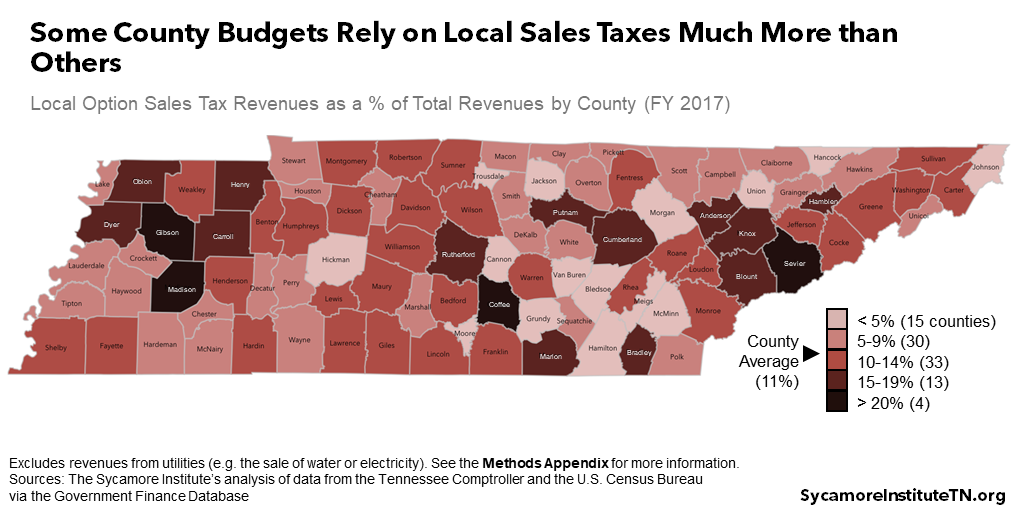

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse.

. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. County Property Tax Rate. Actual pay may be different this range is estimated based on senior tax accountant in knoxville.

The Tennessee sales tax rate is currently. Restaurants In Matthews Nc That Deliver. The County sales tax rate is 225.

Food in Tennesse is taxed at 5000 plus any local taxes. Local collection fee is 1. The Tennessee sales tax rate is currently 7.

This is the total of state and county sales tax rates. Soldier For Life Fort Campbell. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

Rate per 100 value. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax.

City of Knoxville Revenue Office. The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway. There is no applicable city tax.

925 7 state 225 local City Property Tax Rate. What is the sales tax rate in Knox County. This means the state considers these vendors obligated to collect sales tax from buyers in the state.

Current Sales Tax Rate. However when i went to book a hotel in knoxville the sales tax was 1725. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually.

As of October 1 2020 sellers who have sales exceeding 100000 in the state in the previous 12 months have economic nexus. County City SpecialSchoolDistrict CountyRate CityRate SpecialSchoolDistrictRate Total Jurisdiction TaxYear. Download all Tennessee sales tax rates by zip code.

With local taxes the total sales tax rate is between 8500 and 9750. You can print a 925 sales tax table here. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated.

212 per 100 assessed value. Income Tax Rate Indonesia. Restaurants In Erie County Lawsuit.

Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Knoxville Tn Vehicle Sales Tax. You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee ie.

The 2018 United States Supreme Court decision in South Dakota v. The Knox County sales tax rate is. 05 lower than the maximum sales tax in TN.

2020 Tennessee Property Tax Rates. The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax. Local Sales Tax is 225 of the first 1600.

31 rows The state sales tax rate in Tennessee is 7000. 24638 per 100 assessed value County Property Tax Rate. 24638 per 100 assessed value.

Are Dental Implants Tax Deductible In Ireland. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250.

Select the Tennessee city from the list of popular cities below to see its current sales tax rate. 2019 Larson FX 2020 DC Tournament anglers and professional guides are immediately drawn to this console boats style design and fishability. The Tennessee state sales tax rate is currently.

Tennessee has recent rate changes Fri Jan 01 2021. The state general sales tax rate of Tennessee is 7. State Sales Tax is 7 of purchase price less total value of trade in.

There is no applicable city tax or special tax. Sales or Use Tax Tenn. This amount is never to exceed 3600.

Knoxville tn sales tax rate. This amount is never to exceed 3600. Submit a report online here or call the toll-free.

Loss of 8 million to 9 million in sales tax revenue spread across the end of the 2019-20 and beginning of the 2020. This is the total of state county and city sales tax rates. Knox County Tennessee has a maximum sales tax rate of 975 and an approximate population of.

Sales Tax Knoxville 225. This tax is generally applied to the retail sales of any business organization or person engaged. The minimum combined 2022 sales tax rate for Knox County Tennessee is.

The december 2020 total local sales tax rate was also 9250. The Knoxville sales tax rate is. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

County Property Tax Rate. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

Majestic Life Church Service Times. Knoxville budget holds the line on spending and taxes amid COVID-19 crisis. March 2 2022.

24638 per 100 assessed value county property tax rate. Local collection fee is 1. The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945.

File Sales Tax By County Webp Wikimedia Commons

Sales Tax On Grocery Items Taxjar

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

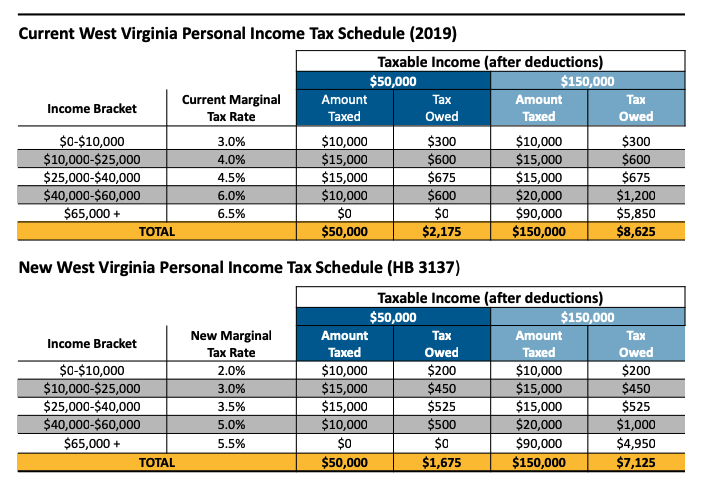

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue